31 January 2016

Specimen of a 100,000 Iranian rial note

There’s been so much buzz about Iran this past few weeks, following the lifting of sanctions and timed no less with the state visits of President Hassan Rouhani to Italy and France. So far we’ve not seen any Charlie Hebdo cartoons lampooning the president. That’s probably because Rouhani was one of the first Muslim leaders to condemn the attacks on the newspaper and the murder of its journalists.

Ironically, however, Ayatollah Ali Khamenei, Iran’s supreme leader, saw it fit to mark Holocaust Memorial Day by publishing a video questioning the Holocaust – during Rouhani’s official European trip! How can two leaders of the same country appear to project vastly different ideas?

In order to find a logical answer and gain better insight, we asked our Iranian friends to shed some light as well as re-read Hooman Majd’s book (see below). “The Paradox of Modern Iran”, as it says on the cover, is quite apt. Iran is a unique country, with unique inhabitants, culture and psyche. It’s home to one of the world’s oldest civilisations. In other words, it’s an intelligent nation. Thus, when its leaders talk, however divergent their views may sound, they speak as one voice. Confused? Don’t be.

A very good read: “The Ayatollah Begs to Differ” by Hooman Majd

Hardly surprising then that the Iranians have finally cut a deal with the West, a move that will benefit the country and its people. Of course, the West gains, too, particularly the French (and especially Airbus and Peugeot). France is the abode of choice for many Iranian migrants. Indeed, Ayatollah Khomenei spent time in a Parisian suburb before returning to Tehran in 1979 to lead the revolution.

Airbus and Iran

In a fairly brief media release on 28 January, Airbus said it had signed agreements with Iran Air for 118 new aircraft, including 73 widebody aircraft and 45 narrowbody planes. This includes 21 A320ceos, 24 A320neos, 27 A330ceos, 18 A330-900neos, 16 A350-1000s and 12 A380s. It didn’t specify when the first deliveries would take place but one thing is certain: this is worth billions, not to mention jobs.

“The skies have cleared for Iran’s flying public and Airbus is proud to welcome Iran’s commercial aviation back into the international civil aviation community. Today is a significant step in the overhaul and modernisation of Iran’s commercial aviation sector and Airbus stands ready to play its role in supporting it,” said Fabrice Brégier, Airbus President and CEO.

Here’s what we know of Iran Air … founded in 1944, flies to 60 destinations, has just over 40 aircraft (half of them Airbus) with an average age of almost 25 years. Safety, therefore, is clearly an issue due to sanctions, with several incidents (some fatal) in recent years, notably a Boeing 727-200 that crashed in 2011, where 77 out of 105 passengers died. To be fair, Iran Air has done well under the circumstances, and perhaps in a testament to its engineers’ ability, has operated vintage Boeing 747s without major accidents.

Thus, it wasn’t at all surprising that Iran Air chose Airbus to overhaul its fleet, given the number of Airbus aircraft already in its fleet, and the fact that Airbus executives have been in and out of Tehran, cosying up to key officials, for many years. What about its rivals from Seattle? At an aviation conference held in Tehran on 16 January 2016 – attended by 85 aerospace firms – nobody from Boeing came, underscoring just how fragile and sensitive things still are between Iran and the U.S.

Will Mahan Air, a private carrier based in Tehran, choose Boeing over Airbus? Unlikely. The U.S. has described the airline as a material and transportation supporter of terrorism “for providing financial, material and technological support to the Islamic Revolutionary Guard Corps-Qods Force (IRGC-QF).” A case of Boeing, Boeing, gone?

On 21 January 2016 Mahan restarted flights (4x weekly) to Moscow using an Airbus A310. Mahan’s fleet is predominantly Airbus, namely seven A340-600s, four A340-300s, 14 A300-600s, four A300-B4/B2 and 10 A310-300s. It also operates 17 BAE146s and just two Boeing 747-300s. We believe Mahan will most likely also look to Airbus to upgrade its fleet, in the not so distant future.

Islamic Finance and Iran

How will Iran Air pay for all the aircraft acquisitions? Will European EXIM support be sufficient? Will some of the planes be on operating leases? Sale-and-leasebacks? Surely there won’t be any shortage of French banks (BNP Paribas, Credit Agricole for example) that will come to Iran’s help? Or will Iran use Islamic financing?

Could Iran be the next big thing in Islamic finance, like what Malaysia is today? Malaysia is, after all, the top player in Islamic bonds, also known as sukuk. It has many claims to fame, including the first to issue a sovereign sukuk in 2002 (a five-year global sukuk worth USD600 million) and housing the world’s standard-setting body, the Islamic Financial Services Board (ISFB).

Following the Islamic Revolution of 1979 Iran adopted Sharia laws in its banking system. Iran’s government passed the Riba-Free Banking Act in 1983. That meant all banks had to comply and all products had to be regulated accordingly. Would Iran be a threat to Malaysia in Islamic finance?

We think not. For a start, it’s unclear how Islamic investors (the majority of whom are Sunnis) would take to Islamic finance under Shia jurisprudence. Indeed, the theological differences between Shia and Sunnis are at the very heart of the dichotomy between the two sects.

It is thus unlikely, in our view, that a sukuk issued in Iran would readily find takers in the Gulf Cooperation Countries (GCC) or Malaysia. On the other hand, investors elsewhere might have an insatiable appetite for them!

In terms of market share, Malaysia is far ahead of its rivals. It has 16 fully-fledged Islamic banks, including five foreign ones. Its total Islamic bank assets are around USD135 billion, accounting for about 21% of the country’s total banking assets. Its closest competitor, the U.A.E., has seven fully-fledged Islamic banks accounting for USD95 billion of assets, representing about 19% of its total banking sector.

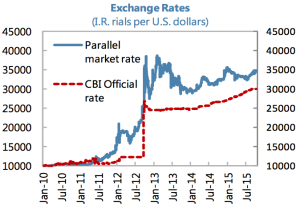

All things being equal, Iran’s investment needs are huge. Its major companies, such as Iran Air, are keen to tap into the international debt market. There’s an acute shortage of hard currency. Just take a look at what the Iranian currency is worth against the USD! Bloomberg estimates close to 200 Iranian firms are eyeing bond sales from this year onwards. This from a country that has tapped the international market just twice in 36 years, according to Bloomberg.

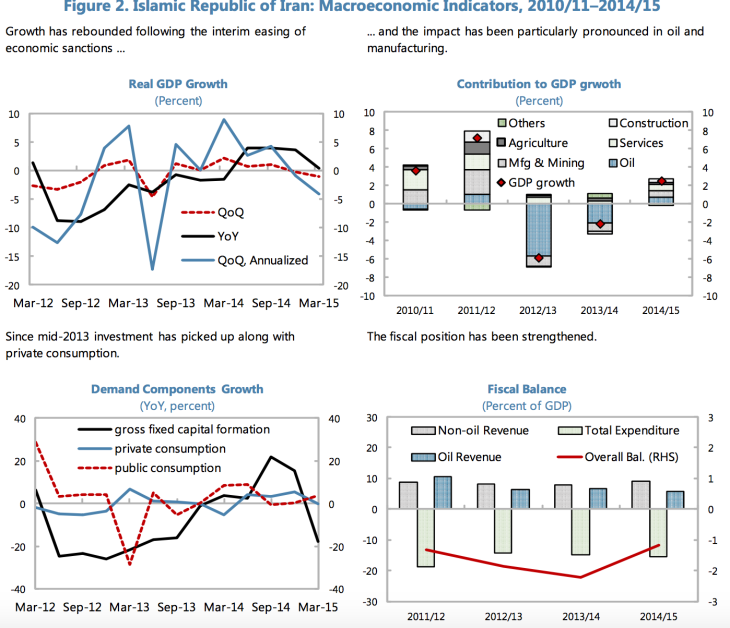

Source: IMF

Neither Iran nor its companies have issued internationally since sanctions were imposed over 10 years ago. The Central Bank of Iran issued a EUR1 billion of paper in 2002, in two tranches of EUR635 million (at Libor plus 3.75%, at a time when Libor was at 5%) and EUR365 million (at Libor plus 2.75%). BNP Paribas and Commerzbank underwrote that conventional issue.

But one critical challenge remains: will international ratings agencies such as Standard & Poor’s and Moody’s – both U.S.-based – be able to rate Iran and its companies? European ratings agency Fitch rated Iran’s bond at B+ in 2002. However, it removed the rating following the bond’s maturity and full repayment in 2008.

What will the Ayatollah say, do?

Iran has significant investment needs. The country has massive potential, a relatively young population (almost half of its 80 million people are under the age of 35) with a high literacy rate of 97% for those between the ages of 15 and 24. Foreign Direct Investments (FDI) will soar, particularly those from China and the U.A.E., two countries which have fostered close economic ties for the past decade.

The supreme leader, the Ayatollah, wields huge control over many facets of Iran’s daily life and economy. He chooses the chiefs of big religious charitable foundations (bonyads) and these have key roles in Iran’s economy – some estimate the bonyads to make up 30% of Iran’s GDP. And how money flows in (and out) of the country will be determined by Iranians, not foreigners.

At the same time Iranian leaders are pragmatists; just look at how cordial Rouhani and French president François Hollande greeted each other! But let’s not get too carried away… There are many uncertainties in Middle East geopolitics. Nothing, absolutely nothing, is cast in stone or what it appears to be.