Home » Strategy

Category Archives: Strategy

Was Malaysia Airlines set up to fail?

“We spend a great deal of time studying history which, let’s face it, is mostly the history of stupidity.” – Stephen Hawking

FOR over a week now Malaysians with (any) interest in the country’s national airline have been giving their (mostly unsolicited) views over remarks made by the carrier’s CEO during an aviation event in Langkawi on 27 February.

Many voiced their opinion on social media, critical of Malaysia Aviation Group’s (MAG) chief, Capt Izham Ismail, accusing him of unfairly blaming the airline’s founders for its deterioration and woes in the past two decades.

During a Q&A session moderated by David Casey, an editor from Routes, an aviation network forum, Izham was asked about Malaysia Airlines’ (MAS) poor track record in recent decades and what actually went wrong.

A reporter who was present at the media conference shared with us a voice recording of the conversation.

Izham’s response: “It wasn’t the emergence of low-cost carriers (which contributed to MAS’ decline in recent times)… reflecting on my journey as CEO over the last seven years, MAS was set up to fail in 1972, with the creation of two separate carriers. People don’t see that.”

However, he did not expand on this casual but controversial allusion to the past and went on to discuss other issues.

And that’s how the miscommunication and misunderstanding started.

But first, a bit of history – the factual, not the stupid part.

Malaysia and Singapore once shared an airline. It was known as Malayan Airways Limited (MAL). It was registered in 1937.

Malaya was then a colony of Britain and this entity was therefore owned by the British: Imperial Airways, Ocean Steamship Company and Straits Steamship Company.

When World War II erupted, MAL was sidelined and only kick started operations in 1947.

Deploying an Airspeed Consul, MAL flew from its hub at Kallang Airport in Singapore, to Kuala Lumpur and Penang, and also to Indonesia (Medan, Jakarta, Palembang), Bangkok and Saigon (now Ho Chi Minh City in Vietnam).

Business grew and by the time the Federation of Malaysia was created in 1963 (incorporating Malaya, Singapore, Sabah and Sarawak), Borneo Airways was absorbed into MAL.

When Singapore was – in the words of its founding father Lee Kuan Yew – “turfed out” in 1965 both Malaysia and Singapore became major shareholders of the new airline, called Malaysia-Singapore Airlines (MSA), with each controlling about 43% in equity.

The remaining stakes were farmed out to the British, namely the British Overseas Airways Corporation (BOAC), Ocean Steamship and Straits Steamship, and Australia’s Qantas Airways. Brunei, too, received a small allocation.

Relations between the two big shareholders were often strained and by January 1971 both decided to part ways.

The divorce was official from 3 April 1972 when Malaysian Airline System was registered and started operations under the new brand in October of that year.

On 28 January 1972 Mercury Singapore Airlines was founded; “Mercury” was inserted as Singapore wanted to retain the MSA label. It was renamed Singapore Airlines (SIA) six months later.

The terms and conditions were agreed upon, whereby Malaysia would focus on its domestic and regional markets and Singapore would pursue destinations beyond Southeast Asia.

Long story short, MAS got what Malaysian politicians then wanted: the domestic and regional markets along with the Rural Air Service (RAS) in east Malaysia that would provide air connectivity to remote areas within Sabah and Sarawak.

Meanwhile, as Malaysia took control of the Fokker 27s for use within the peninsular, Singapore retained the Boeing 707s for its medium to long-haul flights.

It was clear at the time of the split that Singapore (and SIA) already had an edge, both geographically (London-Singapore flights operated by BOAC) and with infrastructure (airport, engineering etc) facilities established on the island state.

Moreover, and this was crucial, SIA was helmed by two incredibly visionary leaders, Joe Pillay and Lim Chin Beng, who laid the foundations for the carrier.

Pillay was born in then Malaya while Lim’s parents came from Penang. Lim himself was born in Indonesia. His successor Dr Cheong Choong Kong, a mathematician, was also born in Malaya but joined SIA in the early 1970s and spent 29 years (19 years as MD) at the airline.

Did MAS get a raw deal?

They say hindsight is always 20/20.

MAS (and Malaysia) got what it wanted, even if that agreement now appears lopsided.

This is not the only contract that some Malaysians have felt hard done by.

The 1962 Water Agreement between Malaysia and Singapore entitles Singapore to take up to 250 million gallons a day from the Johor River.

Singapore pays MYR0.003 per thousand gallons of raw water and then sells treated water back to Johor at MYR0.050 per thousand gallons. This pact expires in 2061.

It may look grossly unfair today but this was what both countries had agreed on.

Admittedly there were many differences between both countries during MSA’s short lifespan, mainly on how the airline ought to be run.

Singapore believed the airline must be commercially driven. Malaysia did not dispute this but felt there was a responsibility to support air services in east Malaysia, even at a loss.

Thus, to say that “MAS was set up to fail” was not only misleading but misguided.

No government, no matter how daft, would knowingly build an airline in order for it to flounder.

Izham was careless to suggest the airline he now leads was “set up to fail.” It was set up to cater to Malaysia’s needs then, albeit without much thought on the future of aviation in the country and of the airline it had just created.

He was, however, absolutely right in implying MAS was disadvantaged from the get go.

“I was merely replying to a question on what went wrong. We must reflect on how the structural deficiencies developed,” he said.

MAS’ negotiators meant well although their choices were probably also influenced by emotion. Relations between the two neighbours in the early years of the divorce were fraught with mistrust and suspicion.

To begin with, the competition for routes resulted in an unfair outcome for MAS during the split. There was a lack of connectivity between mainland Malaysia and east Malaysia where often times flights needed to stopover in Singapore.

Secondly, Singapore had hitherto become a hub for international flights coming into Malaysia and during the six years that both governments shared MSA, Malaysian leaders in Kuala Lumpur never questioned this monopoly.

That said, MAS nevertheless was profitable in its first 10 years of operations.

Despite supporting the RAS, which was perennially loss-making, MAS managed to make money, achieved by cross-subsidising from its profitable regional routes.

“In that sense, MAS had fulfilled its obligations,” Izham added.

Malaysia was successful in its attempt to improve connectivity across the South China Sea, as well as running a profitable airline.

All this happened at a time when the world was a very different place. For instance, despite the oil crisis of 1973-74, jet fuel remained relatively inexpensive and few airlines could challenge SIA or even MAS.

When did it all start to falter?

MAS’ decline, it can be argued, began in the mid- to late 1990s when politicians became embroiled in its ownership and interfered in its operations, including making the airline fly to destinations that were commercially unprofitable, such as Buenos Aires (via Johannesburg), Stockholm and Zagreb (via Vienna).

Compounding this was the government’s choice of leaders to lead the airline, including smart and well-meaning men but managers lacking in imagination, intuition and inventiveness needed to make MAS a winner.

With the advent of LCCs in the new millennium, especially the emergence of AirAsia, and arrival of deep-pocketed carriers from the Gulf – Emirates, Etihad and Qatar Airways – MAS felt the full brunt of it.

Izham lamented: “MAS was not designed to compete in (such) an environment of fierce rivalry.”

No airline is designed to behave in any certain manner, particularly in a fast-changing, erratically evolving world. Airlines either adapt or adjust whilst adhering to strict fiscal discipline and then just hope for the best.

Post-Covid MAS has proven it can not only be profitable but decisive.

A quick resolution during the pandemic to restructure its debts with bankers and lessors was the turning point.

The airline is a lot more stable than what it was a decade ago and the current CEO has lofty ambitions that are well within reach, provided MAS stays the course and takes calculated risks.

When it was set up MAS was short of ideas and, more importantly, short of experts. The irony that its bitter rival SIA went on to become a world class carrier, led by those with roots in Malaysia, has not been lost on many Malaysians.

C’est la vie…

“Our industry always finds a way,” says Air Astana CEO

Air Astana’s story can be simply divided into two periods: before and after Peter Foster.

Foster runs one of the world’s most under-rated airlines – there aren’t too many – and he says the airline’s flexibility and solid principles are the keys to success.

Kazakhstan’s flag carrier has a fleet of 43 aircraft (11 added in the last five years), comprising mostly the Airbus A320 family (including the remarkably resilient and comfortable A321LR) and three Boeing 767s.

Air Astana – also known by its code “KC” – is a relatively small carrier in a country that is ninth largest in the world (population 19 million).

In 2022 the airline posted its highest after-tax profit of USD78.4 million (up 115% year-on-year), on revenues of just over USD1 billion while carrying some 7.35 million passengers.

Its unit cost, commonly referred to as available seat kilometer or ASK, hovers around USD6 cents – amongst the lowest in the world – depending, of course, on the price of jet fuel.

Air Astana’s business model is somewhat peculiar.

When it first flew in 2002, it was neither a network nor discount carrier but a point-to-point airline with not much traffic at its two hubs, Almaty and Astana, and a secondary hub on the Caspian Sea city of Atyrau.

Today it flies to 62 destinations, which will soon rise with the inclusion of Tel Aviv and Jeddah (an interesting pair, no?) and Kuala Lumpur, in the third and fourth quarter of this year.

Talkin’ about a revolution

Foster became Air Astana boss in 2005 – 18 years ago – making him one of the most, if not the most senior airline honcho on the planet.

He landed in Central Asia after spending 16 years with Cathay Pacific Airways and then a three-year stint in the Philippines (helping to restructure the flag carrier PAL), and subsequently a brief sojourn with Royal Brunei.

Having read history at Cambridge, he has a plain but proactive approach to managing Air Astana, introducing (in his first few years at the carrier) robust and rigorous concepts to decision-making.

In so doing he sparked a revolution in the way the local Kazakh employees operate the airline.

“Ours is a defensively aggressive strategy,” Foster tells us in Almaty recently.

“We started doing well before everyone else,” he continues, “when we began to offer our ‘lifestyle routes’ during the onset of Covid.”

The idea was to lure middle-class Kazakhs – about 20% of the adult population – to fly to warmer climes, such as the Maldives, the Turkish Riviera (Antalya) and Heraklion in Crete.

After much deliberation Air Astana’s management went ahead and launched a subsidiary low-cost carrier, FlyArystan, in May 2019.

The LCC has been a runaway success, growing by an astonishing 366% since its inception, Foster reveals, with the region perhaps having the world’s fastest growing discount travel market globally.

FlyArystan operates independently, with its own management team but the parent airline retains overall control in order to maximise synergies.

Kazakhstan is rich in resources (anything on the periodic table, one can find or rather, mine it there), driven by oil and gas, and so Air Astana has benefitted greatly from a thriving domestic market.

To paraphrase Tolstoy, healthy economies are all alike; indeed, Kazakhstan’s GDP will likely expand 3.5% this year and 4% in 2024, according to the World Bank.

Additionally, Kazakhstan remains the only sovereign in the region with an investment-grade rating (BBB- with a stable outlook from S&P).

An on-going war but opportunities abound

While the western media continues its obsession with Russia’s invasion of Ukraine – how this might eventually play out and if Central Asians, specifically Kazakhs, are going to be better or worse off (they are doing well, thank you very much) – Foster has a slightly different view.

“I’m not at all under any illusion about the magnitude of the challenges we are facing but the war hasn’t hurt us,” he stresses, referencing too, to Kazakhstan’s social uprising in January 2022, growing geopolitical grievances in eastern Europe as well as the carbon emission crisis.

On the topic of sustainability and sustainable aviation fuel (SAF) Foster believes it is never going to replace jet fuel.

“That said, I’m optimistic about what Airbus is doing with hydrogen, and what our industry is doing through various other initiatives. We (airlines) need to persuade our governments more to act. The aviation industry always finds a way.”

Foster is extremely confident of Air Astana’s near- to mid-term future.

The airline is growing significantly, resulting in the acquisition (via Air Lease Corp) of three Boeing 787 Dreamliners starting in 2025 (to replace the B767s) and maybe a few more A321s, if available.

The thinking behind this is to add more passengers without necessarily adding too much capacity, and with Air Astana’s current load factor of just over 70%, there’s plenty of room to manoeuvre.

However, the downside to this rapid growth will mean the exit of the carrier’s fleet of five Embraer E190-E2, dubbed the snow leopards.

The Brazilian jets entered service in December 2018, amidst much fanfare, but almost five years later are looking jaded and tired and will be phased out in 2024.

To list or not to list, that is the question

There is, finally, the subject of Air Astana’s much-talked about (since 2011, in fact) desire to have an initial public offering (IPO).

It may be a blessing in disguise this hasn’t happened as the reasons for Air Astana to be listed, in our view, aren’t that compelling.

The airline’s unique selling proposition (USP) includes its brand and reputation and being the top carrier in Central Asia for the best part of the past decade.

Air Astana has a strong track record in safety and for providing excellent service.

There are weaknesses, particularly the need to increase network frequency and connectivity required to stimulate growth.

And more importantly, Kazakhstan’s dependency on energy revenues – any dislocation or mismatch in crude prices affects the currency tenge, which in turn has a negative impact on the airline’s bottomline.

It has thus far been a happy marriage between the two shareholders: the sovereign wealth fund Samruk Kazyna (51%) and BAE Systems PLC (49%).

An IPO brings with it financial benefits, raising capital and improving the company’s balance sheet – funds which can be used towards reducing debt, finance capex and improving public awareness of the airline as a listing typically generates publicity by making Air Astana known to a potentially wider audience (read: new customers).

The other side of the coin is that a public company faces disadvantages, including the need for added disclosure for investors along with the high costs of complying with regulatory requirements.

On top of that, once listed, an airline is confronted with the added pressure of the market which may make management lose sight of the bigger picture, focusing more on short-term results than long-term growth.

There will be closer scrutiny, too, on management from new investors looking for constant and consistent dividends and profits.

Foster says he cannot speak about the IPO although Air Astana clearly is evaluating it, warts and all.

Nevertheless, he is from the old (Swire) school and having built the airline into what it is today – fun, ebullient and vibrant – will leave nothing to chance.

Rethinking sustainable aviation

Screen grab of Boeing CEO Calhoun taken off a CNBC tv interview.

“The truth is rarely pure and never simple” – Oscar Wilde, The Importance of Being Earnest

On TV David Calhoun comes across as feisty and fearless.

He appears candid and unafraid to call a spade a spade.

Since becoming Boeing’s boss in January 2020, he seems to relish the challenges of leading a company which was badly maimed by the MAX scandal.

We have never actually met Calhoun.

We had hoped he would swing by to Southeast Asia – home to nearly 700 million and a region Boeing reckoned will need some 4,200 jets in the next 20 years – but perhaps his PR wonks think it’s not a good idea.

CEOs tend to come only when there are billions of bucks at stake or when asked to accompany your country’s president on a state visit.

Calhoun went to India in 2022 (where he met PM Narendra Modi) and then Air India serendipitously signed a deal for 220 Boeing jets valued at USD34 billion earlier this year.

In March 2023 the Boeing chief was in Saudi Arabia where he oversaw the sale of B787s to Saudia and Riyadh Air worth USD37 billion (at list prices, including options).

Our interactions with him have thus far been virtual, listening to him talk (mostly on CNBC’s Squawk on the Street), watching him on YouTube, reading his emails to Boeing staff (he calls them “team-mates”) and speaking to people who have had dealings with him.

The first thing that strikes us are his words and how he phrases them.

In an interview with the Financial Times on 23 May, Calhoun was refreshingly forthright.

While most OEM and airline bosses waffle their way, stating the obvious on sustainable aviation fuels (SAF), Calhoun is not one to mince his words.

SAF, Calhoun told the FT, will “never achieve the price of jet fuel.”

To say this is a slight departure from the mainstream aviation mindset is an under-statement.

While we are constantly inundated with the phrase “net zero” and constant pledges by airlines to push up the use of SAF, Calhoun took a different view.

“I don’t think that will ever happen (SAF priced like jet fuel),” he stressed. “It’s gonna be what it’s gonna be.”

If it ain’t SAF, we ain’t flyin’

The issue with SAF is not just affordability but availability. In Europe it’s been estimated that even if scaled up, SAF will cost three times more than jet fuel.

The reality is, there is a long, long way to go. And 2050 is looking a tad too optimistic.

Aviation accounts for about 2.5% to 3% of the world’s carbon emissions.

Some have even gone so far to suggest that a seven-and-a-half-hour flight (e.g. Singapore-Tokyo or Singapore-Sydney) produces 0.7 tonnes of carbon per passenger in economy class.

This, they claim, is equivalent to an entire year’s carbon emission by an average person in a third world country.

However, it is not just about CO2 emissions.

Studies have shown that flights also generate contrails, cirrus (cloud) changes, particulates, water vapour and nitrogen oxides – stuff that makes our planet warmer.

In 2021 the White House announced a SAF Grand Challenge whereby the goal is to supply 3 billion gallons of SAF annually by 2030 and 100% of expected commercial jet fuel by 2050.

And Boeing dutifully said it will do its part by agreeing to buy – wait – 5.6 million gallons of SAF from Neste to support its US operations in 2023.

Développement durable

Meanwhile, over in Toulouse, Calhoun’s counterpart at Airbus has a similar inkling about SAF.

If Calhoun is blunt with his comments (honed by many years of deal-making on Wall Street), Guillaume Faury, the suave Frenchman helming the European aerospace giant, is more circumspect and diplomatic.

“By 2030, SAF will need to be produced at many times the level of today… ambition is not yet matched by action,” he lamented in a subtle, Gallic way.

Which explains why Airbus is betting on hydrogen.

In a CGTN interview in April, when he accompanied President Emmanuel Macron on a state visit to China, Faury confirmed Airbus remained committed to a hydrogen-powered aircraft in 2035.

We have had the privilege of meeting Faury (thank you, Airbus communications team – the best in the business), and on the strength of his responses to our questions, we are confident this goal will be achieved.

Faury’s flair fits in nicely with an aircraft maker that sits on top of the pyramid, synonymous with products that are chic and made with elan.

But if there is a foible in Faury’s diction, it must be his penchant for the word “granular.”

His tendency to pepper his remarks during Q&A sessions, such as – “very deep and granular” or “very granular work” or “we will have a more granular picture” – is surely guff.

This has indeed become quite pervasive and has rubbed on to at least another senior member of the Airbus leadership.

When Julie Kitcher, EVP Communications and Corporate Affairs and a member of the Airbus Executive Committee, spoke about sustainability on 29 March in Singapore, she too gravitated to granularity. Twice.

You spin me right round, baby

On the topic of sustainability, you might fall off your chair then when we tell you that Marie Owens Thomsen, chief economist at the International Air Transport Association, said fares will stay high until around 2040.

Sharing her outlook during the recently-concluded IATA AGM in Istanbul, Thomsen gave a simple argument.

“To be a robust business, everybody needs to cover their costs,” said Thomsen.

SAF are multiple times costlier than jet fuel, and so airlines have to up airfares or “they will start making losses again, which is not in the interests of anybody.”

Especially not IATA’s.

We do understand the airlines’ plight.

In 2015, when crude fell over 50%, airlines continued to charge baggage fees (ostensibly introduced to offset fuel prices) and airfares did not come down.

In airline economics, there are many ways for carriers to tweak airfares.

Adding or subtracting capacity is one. Post-Covid many airlines have yet to fully restore capacity because… because they can afford not to.

Still, by the time 2040 comes around, SAF may well be another unfashionable acronym – stale and fetid – in a world that continues to spin for no other reason than to make plane-loads of money.

Coalition Malaysia

Anwar Ibrahim inherits a country with rising debts and a polarised population. Without a parliamentary majority, the new premier will be hamstrung

Red is the colour of hope… or a warning sign? Harapan flags fluttering a fortnight after Malaysia’s election.

It was never meant to end this way.

Malaysia’s 15th General Election (GE15) produced a hung parliament which the country was unprepared for and which has resulted in a fragile coalition.

Still, some Malaysians are happy with the outcome, though not quite as exuberant as when Mahathir Mohamad led a hodge-podge alliance of opposition parties to a shock 14th General Election (GE14) victory on 9 May 2018.

Then, as now, a new prime minister has arrived in Putrajaya, full of fervour, full of hope.

How will Malaysia’s 10th prime minister Anwar Ibrahim lead and manage, or will he simply reign?

His elevation has been widely welcomed and has sparked quite a buoyant national mood.

What Anwar actually got was an election that not a single party won outright, a mixed mandate and an uneasy union.

For a start there will be constant pressure on the coalition, dubbed a “unity government,” to justify its legitimacy in response to criticisms that no one voted directly for it.

Even if Anwar claims his cobbled-up government has an overwhelming majority of at least two-thirds, simple arithmetic, when broken down and dissected, reveals a different picture.

The Dewan Rakyat comprises 222 parliamentary seats, with 166 or 75% in peninsular Malaysia and the rest (56 seats or 25%) from East Malaysia: 31 in Sarawak and 25 in Sabah.

Although the results of GE15 showed Anwar’s Pakatan Harapan (PH) consortium winning 82 seats, it collected just 11% of the Malay votes, in a land where the Malays (excluding other Bumiputeras) comprise close to 60% or almost 20 million of Malaysia’s 30 million citizens.

UMNO, the right-wing United Malays National Organisation which had dominated until 2018, gathered 33% while Perikatan Nasional, a league consisting the nationalist party Bersatu and Parti Islam Se-Malaysia (PAS), achieved an astonishing 54%.

More surprisingly voters in Permatang Pauh, a constituency in Penang state where Anwar first contested in 1982 and which has since been successively defended, including by his wife and daughter, rejected him this time round.

Anwar would thus do well not to think results from the GE15 equalled an overwhelming stamp of approval, when just a handful of the Malay electorate voted positively for him and PH.

And despite suggestions that the administration reflects a new era of political maturity – a unique blend of Malaysian horse trading – the opposite is true.

The nature of alliances means different views need to be accommodated but politics in Malaysia are so fragmented it has exposed rifts within society which a change of government can do little to address.

The majority Malays are basically divided into three tribes, with their respective leaders jostling for influence and power.

Sectarianism has become the norm, with conservative Malays adhering to a defiant and distant doctrine from the one PH adopts.

Their political beliefs seem incompatible with urban and moderate Malays who form the bulk of Anwar’s support.

And then there are the orthodox followers of PAS, who have raised the party’s number of seats by a colossal 172% (from 18 to 49) and will make it a formidable political force in parliament.

Will the coalition survive?

Anwar has formed a line-up where, in football parlance, he is the captain, libero and striker, all rolled into one.

But this team is flawed with many fissures.

For one, it does not have a solid fan base, because it is a squad borne out of political expediency, rather than shared hopes, beliefs and passion.

Two, there is a lack of common vision on what it is trying to accomplish and three, it has no credible coaches and strategists.

On a personal level, Anwar’s relationship with deputy PM Zahid Hamidi, 69, UMNO’s chief and a loyal friend for decades, has always been good; a leaked phone call with Zahid ascribing Anwar as his mentor further attest to this.

Conversely, nobody would pretend that Rafizi Ramli, 45, the economy minister and PKR’s No.2 leader, and Zafrul Aziz, 49, the minister for international trade defeated during the polls, are buddies.

While personal differences can be overcome with Anwar at the top, new policies may not be easily approved due to deep and divisive ideological differences.

Many Malaysians are now mimicking the narrative about “making Malaysia great again,” a slogan paraphrasing Donald Trump and espoused in a recent open letter by Lim Kit Siang, an ex-leader of the Democratic Action Party (DAP), a core component of Anwar’s PH pact.

Malaysia was once very good, but it was neither great nor a time machine; the country cannot turn back the clock and return to what it was before.

Malaysians of a certain generation long for those halcyon days when there was more predictability, social cohesion and an underlying stability which allowed the economy to prosper and generate a golden era of growth.

This nostalgia for that period obscures the reality.

Malaysia is a different country today.

Anwar comes into office inheriting debts and liabilities of some MYR1.42 trillion (USD320 billion) and his past accolades and experience as finance minister in the 1990s – when the world was a less complex place – will not help much.

Federal government debt accounts for 61% of debt-to-GDP, at MYR1.04 trillion, up from MYR979.8 billion in 2021. Total debt and liabilities hover around 84% of GDP, according to the auditor-general’s report.

By comparison, the US national debt stands over USD23 trillion while regionally Thailand’s is USD243 billion, Vietnam’s is USD145 billion and USD231 million for the Philippines.

One reason for Malaysia’s stagnant economy since the new millennium is that past governments did not embark on bold and usually unpopular reforms which a modern economy needs.

There can therefore be no financial and social reformasi unless Malaysians take a long, hard look at themselves and decide – soberly, not emotionally – what they can and cannot realistically achieve.

This is where Anwar can assert himself.

Under the constitution, the PM is not just first among equals, he also enjoys the right to set the tone of government policy.

Anwar will be the central figure in this new Malaysia.

His first words uttered to the international media were: “This is a national unity government and all are welcome on condition they accept the fundamental rules: good governance, no corruption and a Malaysia for Malaysians.”

The concept of a Malaysian Malaysia is seen as taboo, associated with the late Singaporean leader Lee Kuan Yew in the early 1960s, and had been one of the key contributors to Singapore being “turfed out” of the federation in August 1965.

Malaysian Bumiputeras, or sons of the soil, enjoy many educational and social benefits under the New Economic Policy (NEP), a race-based policy that was crafted in 1970 following communal riots the year before.

Anwar is unafraid to denounce the NEP, calling it “a gimmick for those in power in UMNO to virtually rob wealth opportunities for themselves” during an Asian Financial Crisis talk at Singapore’s Nanyang Technological University in 2007.

His idea of reformation is at odds with Malaysia’s traditions.

While his intention is undoubtedly noble in wanting to build a Malaysia for all Malaysians – irrespective of race and religion – as PM he is constitutionally obliged to defend and uphold Malay rights and Islam as the official faith.

How will Anwar appease and acquiesce to the growing demands and expectations of non-Malays, many of whom see him as Malaysia’s messiah and voted for him, in a system that by definition and design provides privileges to the Bumiputeras?

Older and wiser?

Online entrepreneurs have taken advantage of Anwar’s victory. Here the Malaysian PM is the face of a Hotwheel pickup.

In Malaysian politics, like those in the US, China and India, gerontocracy rules.

It was never like this when the country was growing up.

Najib Razak, currently jailed after being convicted for the 1MDB fiasco, was 56 when he became PM in 2009, coincidentally the same age Mahathir was when he was first anointed in 1981.

Najib’s father Abdul Razak was Malaysia’s youngest ever PM.

He was appointed in 1970 aged 48; two other former PMs – Abdul Rahman and Hussein Onn – Malaysia’s first and third, were both 54 when they took office in 1957 and 1976, respectively.

When Mahathir, then 93, led for the second time in 2018 he created the Council of Eminent Persons, a five-member group whose average age was 76 – fondly called the Geriatric Gang – to advise on economic and financial matters.

A nation run by political dinosaurs, when the median age is 30.4, will hurt Malaysia in the mid- to long-term.

One reason for this gerontocracy is that previous leaders, like Mahathir and Najib, assumed power at a relatively young age, drawing on decades of political capital, ensuring themselves almost unlimited years of rule.

Anwar could be an exception though.

At 75 he appears robust and sprightly, and has a prodigious appetite to engage with the intelligentsia and keep up with world affairs and new technology.

His success is in convincing voters that his incarceration between 1999 and 2010 (plus a brief jail time in 1974 when he was a student activist) and stints as agriculture, education and finance minister make him a natural leader.

Indeed, he has been hailed as Malaysia’s Mandela, a comparison Anwar himself found rather flattering, if not a little discomfited.

Hung parliaments of the future?

There has been no historical precedence of a hung parliament in Malaysia, making it difficult to analyse its political or institutional implications.

This has arisen due to the rise of multi-party politics resulting from profound social developments which have taken place in the past decade.

The transition, from big blocs based on race, like Barisan Nasional (UMNO, together with the Malaysian Chinese Association and Malaysian Indian Congress in the past) and DAP, to a more socially fragmented society has weakened the focus on party identification.

Malaysia’s geographical fragmentation is also more pronounced, between city folks and countryside dwellers.

The recent election was fought not on a national basis but within regional belts dotted by race and religion.

This explains PH’s narrow base of support from the Malays, and its inability to garner a national mandate overall, making it incredibly tough for this “unity government” to achieve its goal of unifying people.

Additionally with hung parliaments, the raison d’etre of polls is modified.

Instead of directly choosing a government, future elections could be about adjusting the power relations between parties, thereby affecting their strengths in post-poll wheeling and dealing.

Now that the possibility of future hung parliaments is higher than ever, voters should demand that parties tell them before rather than after GE16 with whom they would consider forming a coalition and which items in their respective manifestos are negotiable, and those which are not.

Meanwhile Anwar has his work cut out for him.

His job and that of his cabinet – if it lasts the full term – is to simply deliver on policies that immediately affect Malaysians’ lives.

And please, no more macho talk about pay cuts, eschewing luxury cars or austerity measures whilst loss-making GLCs and the sovereign wealth fund continue to pay their top executives millions in remunerations.

Recent turmoil in Malaysian politics since the “Sheraton Move” of February 2020 has led to many citizens agreeing on one thing: what the country needs now are competent, (relatively) honest leaders and less drivel.

Guff in the time of corona

Barely 63 years and two months after Malaysia celebrated its independence on 31 August, its citizens received a belated birthday note from the flag carrier: we are bleeding USD84 million a month, says the airline’s parent company, and need billions to stay in business.

Another restructuring therefore, is to be undertaken by Malaysia Aviation Group (MAG), the holding company of Malaysia Airlines Berhad (MAB), to keep the national airline afloat.

In 2014 Khazanah Nasional Berhad (KNB), Malaysia’s sovereign wealth fund (SWF) and MAB’s sole shareholder, laid off 6,000 of the carrier’s employees in a massive overhaul that cost over MYR6 billion.

KNB’s 12-point plan then called for the creation of a newco. It delisted the previous Malaysia Airline System (MAS) at the end of 2014 and transferred operations and assets to the newly-formed MAB in 2015.

Last week MAG confirmed it had written a letter to its lessors, seeking significant reductions on monthly jet rentals. One leasing firm claims the airline is asking for as much as a 75% haircut.

To put things into perspective, MAB operates six Airbus A350s, currently leased at USD1.2 million per aircraft each month. Factoring the discount, the rental of each plane would be whittled down to just USD300K a month.

It has other leased aircraft in its fleet, including 21 Airbus A330-200s/300s and 48 Boeing B737-800s. The jets are mostly idled since March due to Covid-19.

MAG says it will not be able to pay its rentals after November 2020 without fresh funds from KNB.

The group’s current liquidity as of 31 August 2020 was USD88 million; it can draw an additional USD139 million from KNB. It is unclear how much debts are in the books.

KNB will pump in USD1 billion (MYR4.15 billion) in 2021, according to the letter, only if the lessors agree to the airline’s request. Additionally, KNB will also capitalise at least USD1 billion of shareholder advances.

If all this does not materialise, MAG will go to court to restructure.

The move is not unexpected. Other flag carries in the region, such as Thai Airways and Garuda Indonesia, are seeking court protection from both creditors and lessors.

Many carriers are emboldened by the success of Virgin Atlantic, the airline partly owned by British billionaire Richard Branson, in getting a high court approval to restructure under Part 26A of the UK Companies Act of 2006, and recognised in the US court, too (following the carrier filing for Chapter 15 bankruptcy).

A key component of this new ruling is that the court may exercise its discretion in using a “cross-class cram-down” procedure. This means if at least one lessor votes to agree to the proposal, the court can order other lessors to be bound by the decision, even if they disagree.

It is unclear if MAG will succeed in a London court but an executive at another aircraft leasing company says the airline will apply for protection in Kuala Lumpur if it fails to convince an English judge.

“They are determined to bulldoze their way through,” he adds.

And in case that does not work, says the letter, the shareholder (KNB) “intends to divert all efforts and funds to an alternative company with an existing air operator’s permit to ensure connectivity for Malaysia.”

This could mean shutting down MAB and potentially using another MAG subsidiary with existing AOC – either MASwings or Firefly. There are even whispers of a potential tie-up with its cash-strapped rival, AirAsia X.

KNB has rejigged MAS before, in 2014. Existing lease contracts were then novated, paving the way for the newly-formed MAB and its then German CEO to renegotiate terms with lessors.

Kill or cure?

Many Malaysian companies (and workers) need help from the government to survive and to prevent from going bust, thereby reducing the prospect of a lengthy recession.

MAB is not one of them.

Whilst the finance minister has repeatedly stressed his government’s unwillingness to bail out any airlines, its own SWF (KNB is administered by MoF Inc and therefore, represents the government) is doing the bidding for MAB, causing confusion.

“Khazanah’s goal is to have Malaysia Airlines achieve healthy, positive margins comparable to its peers, and ultimately provide a positive return on our investment,” KNB says in an official response to the story that was first reported by news agency Reuters.

In reality, however, KNB has failed to rehabilitate the airline.

Since becoming a 100% shareholder of MAB in 2015, the return on its investment has been diabolical.

MAB posted a loss of MYR1.12 billion that year, followed by a MYR438 million deficit in 2016, another loss of MYR812 million in 2017 and a loss yet again in 2018, of MYR777 million, for a total of MYR3.15 billion in the past four years.

It is estimated the national carrier has received, and lost, over MYR25 billion in the past two decades. MAB-related impairments in 2018 alone was MYR3.1 billion, almost half of KNB’s total impairment of MYR7.3 billion.

MAB has yet to file its earnings for 2019 despite its CEO claiming it had made significant improvements last year – “short of 0.7% of targeted revenue for 2019” and “record-breaking passenger RASK results in 2Q to 4Q 2019, the highest ever recorded in 3 years.”

MAB was moribund long before the arrival of Covid-19. Any attempt to blame the health crisis to gain government and public sympathy (and money) is dishonest and devious.

Those who insist the airline is an enabler of Malaysia’s economy need to ask key questions: (a) would a MAB collapse cause a contagion in Malaysia? and, (b) are there other options than using taxpayers’ funds to save the carrier?

The respective answers are “no” and “yes”.

As we have argued before, if MAB were to go under, the accompanying loss of capacity would be quickly replaced by other carriers – in Malaysia’s case, AirAsia and Malindo.

A taxpayer-funded rescue of MAB would just prolong the pain and the losses, while extending a lifeline to an inept and incompetent management.

The best way to help MAB is not to infuse more money but rather, creative destruction: let it die and rebuild a new entity, with a new management, strategy and vision, run by Malaysians who fully understand the aviation industry.

The aviation landscape will be drastically transformed post-Covid-19. Despite government support, many airlines, including MAB, will be losers, if still led aimlessly by managers and shareholders with obsolete ideas.

Ants in your pants

When the current CEO was appointed as head of MAB end-2017, he told the local media: “I’m not the smartest kid on the block, but I have a heart of rock.”

A person with a rock heart, according to the Oxford dictionary, is a “cold or unfeeling person.”

Colleagues describe him as neither cold nor unfeeling, but “expressive”.

He once expressed his devotion to all 13,000 of MAB’s employees, a la Tom Cruise in the movie Jerry Maguire, declaring: “I love every single one of you, you guys complete me.”

Although he admits to not being the sharpest tool in the box, MAB’s commander-in-chief has unconventional ways to rally his soldiers.

He writes to the company’s workers regularly, sometimes praising, sometimes cajoling and occasionally reprimanding, but always reminding them who is in charge.

“My dear colleagues, as your top leader…” reads the start of one message. In another he vows, in Churchill-like manner, to “fight tooth and nail in the trenches, side-by-side with all of you to take us where we need to be…”

His most memorable (thus far) contribution during Covid-19 is a YouTube video – “Rise Above Our Differences” – a 4-minute long clarion call for the demoralised troops to act like ants.

“While a single ant may not be able to achieve much, the colony, when working together, becomes truly something awe inspiring,” MAB’s chief ant observes.

Many older Malaysians look back nostalgically on a time when MAS (the precursor to MAB) ranked quite highly in the world.

It produced many skilful pilots (including the incumbent CEO), able and astute aircraft engineers and classy cabin crew that were consistently rated in the top 10 by Skytrax and others.

There is, sadly, no justification to save MAB in its current condition. Only hubris.

Even the ants know that.

Investor tells SIA: SQ-ew you!

There is an airline investor who is so upset with Singapore Airlines (SIA) that he has written, via facebook, to Singapore’s prime minister requesting the removal of the company’s chief executive, Goh Choon Phong.

The SIA stalker goes by the moniker Seng Hoo Lim and claims to be both a shareholder and frequent flyer.

What is his problem?

As a stakeholder who had recently subscribed to SIA’s rights issue, he is livid with the CEO for allowing the flag carrier to allegedly accumulate jet fuel hedging losses of S$3.54 billion (US$2.5 billion).

He had implored Goh in 2015 and again in 2016 for SIA to cease its fuel hedging practices which, he claims, had resulted in the airline “losing market share in many markets”.

For the first time in its history, SIA is finding itself in a rare position – being openly criticised, castigated and chastised – by a sizeable number of citizens and the local media, who had hitherto used kid gloves to rebuke the carrier.

Many Singaporeans once assumed that their national airline was largely immune to the vagaries of the aviation industry which had afflicted other airlines.

After all, SIA had never lost money in a calendar year (not even during SARS), leave alone going cap in hand to its major shareholder seeking handouts.

Even the usually mild Business Times joined the chorus of critics, admonishing the once peerless airline on 23 September and positing that, reduced demand brought about by Covid-19 aside, “SIA has major problems to fix”.

It cited the carrier’s poor investment track record in overseas ventures and, with the help of various equity reports, singled out SIA’s controversial bets in the jet fuel futures market.

Gambling on crude prices is a bit like taking a punt on when the virus will be eradicated, if at all. You just do not know.

It is deceptive and volatile and unpredictable. Pretty much like selecting strategies for a World Cup final match: should your team play total football or deploy catenaccio?

Hindsight is always 20/20 and that is hedging.

It is incredibly tough for SIA (and any other airline) to successfully hedge and defend its hard-earned money against crude, a commodity whose prices are less determined now by market forces than by geo-politics.

The best and brightest at many airlines have come up short in the hedging circuit. In principle one does not hedge to make money (good if you could) but one goes into a hedge to reduce volatility.

The cumulative hedging losses pin-pointed by Seng Hoo Lim are undeniable.

More importantly, the costs of engaging in hedges and the duration – what drove SIA, for instance, to hedge so far out into the horizon, for five years?

The airline says it has always been transparent about its hedging policy.

But how does it explain the huge loss (S$1.1 billion) in 2016 when oil traders generally agree it was the least volatile year this past decade?

All things being equal, if CEOs are to be ejected from their posts solely from hedging losses, then very few airline bosses would survive beyond a couple of years.

It is not a good enough reason to boot Goh out on the basis of hedging losses. Other CEOs have lost lots more and been more reckless fiscally.

Admittedly SIA does have problems – existential or otherwise – that need fixing, but those which have been highlighted are mostly structural, including its long-held strategic obsession with high-end, luxury air travel.

These can be quickly resolved.

An SIA state of mind

One thing that is not easily fixed is attitude.

Attitude is everything, they say.

That SIA is able to soar continuously above the competition, retaining its air superiority over some of the wealthiest and most aggressive of rivals is quite a feat.

But SIA’s highly regarded leaders would do well also to maintain a dose of humility at home, on terra firma, and not exhibit an air of superiority over lower-ranking employees.

In short, SIA must listen to, not lord over, its people.

Past and present SIA rank-and-file workers have long grumble over the haughtiness of some senior executives and managers.

Arrogance and the “I know best” approach apparently permeate across Airline House and within the company.

Recently retrenched part-time flight attendants at one of its subsidiary airlines claim they were terminated by a mere phone call, not personally.

Cabin crew at the parent airline are exasperated, too, seeing how management had allowed pilots to strike a deal, agreeing to take deeper pay cuts instead of being culled while those who serve passengers take the brunt of the lay-offs.

Are pilots a special breed, they questioned.

In some ways SIA is a victim of its own success.

It is widely admired, respected and envied because it has excelled in a cut-throat industry, year in, year out.

SIA has flourished and thrived despite its handicap: absence of domestic market and Singapore’s small size (tiny, physically and population-wise).

Changi (and by extension, Singapore) is one massive air hub with SIA providing the extensive network (spokes) that attracts travellers from many continents to transit at the airport and onwards to hundreds of destinations served by the flag carrier.

The airline played its role to perfection previously.

Until now.

If any single event sums up the danger and enormous opportunity faced by SIA, the pandemic is it.

Coming to terms with the need for radical in-house rehabilitation is crucial to SIA’s survival.

Speaking about change is one thing; adjusting the corporate culture is another.

“Move beyond” the unknown

The iconic skyline of hong kong island. pic/shukor yusof

“I am in dread of the judgment of God upon England for our national iniquity towards China” – William Gladstone

Modern China is a beast both the US and the UK cannot, however much they try, control and corrugate.

The transformation of China has been long and painful.

Economic and social changes have taken place in a very short space of time, shorter than during its past history, starting from Deng Xiaoping’s “Open Door Policy” in 1978 to the Tiananmen Square protests in 1989 and most recently, President Xi Jinping’s move to turn Hainan into a free trade port.

In just over four decades China has morphed from a backward, under-developed society into the world’s second-largest economy, and the second-biggest holder of US treasury debt (USD1.08 trillion against Japan’s USD1.27 trillion).

It is difficult to fully appreciate and grasp the changes of the past 40 years without studying and understanding China’s political system, social structure and economic institutions in the past, particularly events in the 18th and 19th centuries.

There were several major forces that shaped modern China. After its defeat to Britain in the Opium War, followed by the Anglo-French occupation of Beijing in 1860, China’s elite knew the country had to change if she was to survive.

The Middle Kingdom had much to learn from the barbarians.

The Chinese initiated the Self-strengthening Movement in the 1860s, using the buzzword of the day then, coined by Wei Yuan, a famous scholar, that went thus: “learn the superior barbarian technique with which to repel the barbarians.”

Alas, this movement – focused mostly on military strength of the West – proved insufficient, evident during the defeat to the Japanese in 1895, and the Chinese realized any meaningful attempt at modernization must include political reform.

China, Hong Kong & the West

In recent weeks unrest in Hong Kong over the introduction of a national security law has led observers, particularly those in the West, to question if the “one country, two systems” principle has any relevance.

China’s view though, is this: there is only China – the One China Policy – and that all of it is under one single, indivisible sovereignty, which also includes Taiwan.

But Taiwan is another story, for another day.

And Taipei should heed the warning from China that any attempt to give refuge to Hong Kong “rioters” would only “bring harm to Taiwan’s people”.

Hong Kong’s transformation, from a British colony to a Special Administrative Region of China, had been relatively smooth until mid-2019 when the Hong Kong government introduced an “extradition bill” which, if enacted would have allowed extradition to jurisdictions which Hong Kong currently does not have agreements with, including the mainland and Taiwan.

Following widespread opposition and subsequent rioting, the bill was formally withdrawn on 23 October 2019.

However, confrontation and tension between the territory’s leadership and many Hong Kongers remain on-going and have damaged business confidence as well as the territory’s standing as a financial centre.

Beijing’s recent decision to impose the national security law has further aggravated the situation.

Here’s what we know about this new law so far: read it here.

Any talk of secession from the mainland, undermining the authority of the Hong Kong government, collusion with foreign forces and using violence against people are deemed criminal acts.

Many residents worry, too, over China possibly establishing its own institutions in Hong Kong to handle security affairs.

When Britain handed its colony back to China in 1997 both sides agreed, as part of the Sino-British Joint Declaration, on a mini-constitution known as the Basic Law, along with the “one country, two systems” policy.

However, in 2017 Beijing said the accord with the British was irrelevant.

The proposed new law, according to China, is a critical step in establishing and improving the legal system and enforcement mechanisms in Hong Kong, as well as to safeguard national security.

There are fears, amongst locals and British (and EU) politicians that Hong Kong’s judicial system will be like China’s if the new law is passed.

The British government is so upset that its premier Boris Johnson is offering eligible Hong Kongers almost 3 million British National Overseas passports, a document which allows its holders to live and work in the UK.

But has Britain conveniently forgotten something?

When Hong Kong was under British rule, the Treason Act of 1351, also known as “Statute of Treasons”, applied to the colony. The Act was designed to punish people plotting or “imagining” the death of the monarch, “levying war” or “adhering to the King’s Enemies”.

What does all this mean to Cathay Pacific Airways?

Cathay Pacific Airways is living on borrowed time.

Despite assurances by its chairman that the airline’s long-term future is bright, doubts remain.

For one, Cathay’s destiny is inextricably linked to the fate of Hong Kong.

China has no intention of destroying Hong Kong but many of the territory’s citizens – with their incessant demands for greater freedom (some even clamoring for independence) and willingness to use violence – are jeopardizing their own prospects.

Both Cathay and Hong Kong’s Chek Lap Kok Airport depend much on tourism, as do the hotels, theme parks, restaurants and retailers on Hong Kong Island, Kowloon and The New Territories.

The riots and protests in the second half of 2019 resulted in tourist arrivals falling by almost 40%.

And the jobless rate rose to 4.2% in March 2020 (from 3.7% in the Dec 2019 to Feb 2020 period) – the highest in nine years – partly due to COVID-19 as well as the political impasse.

Hong Kong is experiencing negative economic growth – its first in a decade.

Its position as a financial hub is at risk.

No airline can flourish under such bearish conditions.

There is the HKD39 billion (USD5.03 billion) rescue package crafted by Morgan Stanley allegedly within three months for Cathay, but money burns fast in the airline business and it won’t guarantee the airline’s survival long-term.

Here are more details of the Hong Kong government bailout.

Morgan Stanley is earning nice fees at the expense of struggling carriers. (In July 2019 the Wall Street investment bank was mandated by Malaysia’s Khazanah Nasional to find a fix for Malaysia Airlines. So far, nada.)

As Hong Kong’s economic future hangs in the balance, so does Cathay’s.

Beijing has shifted its focus to Hainan Island, a 50-minute flight from Hong Kong.

And the Chinese are hoping it can lure foreign investors to the balmy island after President Xi announced the creation of Hainan as a free trade zone.

This isn’t just empty talk.

A new airline, Sanya International Airlines, is to be launched soon.

It will be partly owned by China Eastern (51%) and the rest by Juneyao Airlines and Trip.com.

Hainan is nearly 30 times larger than Hong Kong and is popular amongst mainland Chinese as a resort destination. It is the venue for the annual Boao Forum and touted by Beijing as the “Hawaii of Asia”.

Unlike the mainland Chinese carriers, Cathay’s disadvantage (similar to Singapore Airlines) is that it has no domestic destinations. It has high labour and operating costs and according to an ex-executive, a pestilent workers union.

Finally there is the small matter of Cathay largely controlled by the Swire Group (through Swire Pacific), a conglomerate based in both Hong Kong and London, whose top management remains quintessentially upper crust English.

The majority, or 80% of the company’s 130,000 employees (working in diversified sectors such as property, beverages and marine services) are located in China, Hong Kong and Macau.

Unlike its rival Jardine Matheson Holdings (which started life as drug peddlers, long before the cartels of Colombia), Swire has had a better relationship with the mainland.

But the Chinese have long held a grudge against the British (and other Europeans). The sight of tai pans still roaming around in Hong Kong must rankle a bit with the mandarins in the Party.

In the world of realpolitik it would be judicious to note that Anglo-Chinese relations, while currently cordial, are veering towards antagonism following Britain’s (and the US) stance on Hong Kong.

To paraphrase Harvard economist JK Galbraith, the future of Hong Kong isn’t the American or British future. But it is the Chinese future.

Airlines hedge and (often) lose money

sia’s first airbus a350xwb. pic courtesy of airbus

Nobody knows for sure what oil prices will be in the next five trading days, leave alone the next five years.

Yet Singapore Airlines (SIA), widely acknowledged as one of the savviest carriers in the world, has placed bets on the highly volatile and unpredictable jet fuel market for the next – wait for this – not one, not two, but five years.

The fuel hedging contracts the airline has gone into will last until 31 March 2025.

On 8 May 2020 SIA released a statement saying the collapse of crude recently will result in a loss for the company for the quarter ending 31 March 2020.

Singapore’s flag carrier also warned that it expects to register a net loss for the financial year April 2019 to March 2020 (earnings results are due on 14 May) – the first in its history.

This is not the first time SIA has gambled – and lost – on the futures market.

In 2017 the carrier similarly hedged five years into the future, leading some observers to ask: is the company a full-fledged airline or is it now partly moonlighting as a derivatives trading firm?

In 2014 when SIA had hedged jet fuel at an average price of USD116/bbl it suffered losses when the price of the black gold plunged, resulting in spot market prices of USD85/bbl.

American Airlines, the largest US airline, completely went off hedging after oil prices plummeted in 2014, with its president telling the media then: “Hedging is a rigged game that enriches Wall Street.”

Crude oil’s astonishing decline in recent weeks (at one stage it was trading under water) reminds us, too, of events over a decade ago. In 2008 and 2009 SIA, Cathay Pacific Airways and the major Chinese carriers reported millions in losses due to wrong-way bets on fuel.

SIA now says it is going to “pause and plan to monitor developments closely before entering into any additional hedges.”

To hedge or not to hedge, that’s not the question

Many airlines, especially those with good credits, go into hedging some portion of the anticipated cost of jet fuel purchases over the next few years (typically between 12 to 24 months) as an insurance policy, to cut the risk of losing money if oil prices spike.

Airlines also have the option of remaining unhedged and impose fuel surcharges instead.

Fuel typically makes up around a third of an airline’s operating costs (when they are flying, not grounded as is the case now).

And jet fuel hedging is a complicated and expensive process that takes several forms, including contracts to buy a fixed amount of fuel at a fixed price at a future date, and collars, the right to buy fuel within an agreed band of prices.

The former CEO of British Airways, Rod Eddington, once remarked: “When you hedge, all you do is bet against the experts of the oil market and pay the middle men, so you can’t save yourself any money long-term. You can run from high fuel prices briefly through hedging but you can’t run for very long.”

The people who benefit from hedging – the investment banks – see it differently.

Of course.

Hedges, they claim, should never be seen as bets on markets because no one knows in which direction prices will move.

Proponents of hedging point to Southwest Airlines, the world’s first true low-cost carrier, and a clever user of jet fuel futures contracts.

Between 2001 and 2015 the airline reckoned it saved USD2 billion on its hedging strategies. However, in the past few years fuel hedges were big liabilities for Southwest, and in 2016 it lost close to USD500 million.

The same can be said of Delta Airlines. In 2016 the boss of Delta admitted his airline cumulatively lost some USD4 billion on oil hedges in eight years.

The future of the futures market

Most airlines in Southeast Asia engage in some form of hedging but for many the challenge is more complex as they need to protect against currency swings when they buy jet fuel, which is denominated in USD.

In its defence SIA says its hedging policy in recent times was based largely on capacity growth and aircraft purchases (mostly widebody planes, especially its 19 Airbus A380s that guzzle a lot of fuel), and that it has never been overly ambitious and will remain prudent in all its financial affairs.

That may well be the case and while SIA would not record an annual loss if not for COVID-19, its hedging programme needs a review given the airline’s dismal track record this past decade.

SIA’s share price will in all likelihood take a beating when the Group releases its results on Thursday. That will make many of its retail investors terribly unhappy despite a rights issue that raised about SGD15 billion in total.

That SIA decided to warn the market about its jet fuel losses after it had received state-backed aid from Temasek Holdings has not gone down well, too.

Why didn’t it come clean about those losses earlier?

Why did it stick to hedging too far out (five years) and at a fairly large volume – 51% of jet fuel at USD78/bbl and 22% of Brent at USD58/bbl when it knew from past experience and recent crude instability there could be much volatility?

And why did SIA hedge crude oil contracts (Brent) on top of the jet fuel contracts?

When an airline combines or mixes contracts as part of its hedging strategy, the fees can be significantly higher as it has to take into account the total cost of hedging versus the benefits of hedging before it can come up with the preferred ratio.

It’s safe to bet that with airlines like SIA, Cathay and Southwest, the future of the futures markets remains bright. They will continue not just to exist, but thrive.

Other airlines who do not hedge or are largely unhedged, such as American Airlines, United and Norwegian, should be afraid. Very afraid.

Around 10 years or so ago, there was a sudden and unexpected oil price spike triggered by a rogue trader who bought a huge number of Brent futures contract while drunk in the middle of the night.

According to this newspaper report the miscreant at one point was responsible for nearly 70% of the volume of Brent traded!

It is speculators (and in the above instance, an alcoholic) that dominate the futures exchanges. The original purpose of the futures markets was to reduce risk, yet today it would appear these have become some form of electronic casino gambling, thereby increasing risk.

And all it takes is just one loony with a laptop to create mayhem.

Crisis in Malaysia? What crisis?

let them sleep with the fishes.* Mahathir Mohamad feeding Japanese kois at the perdana leadership foundation in Putrajaya. pic/shukor yusof

2020 – the year in which Mahathir Mohamad had envisaged, back in 1991, where Malaysia would emerge as a developed, self-sufficient, industrialised nation – has not started well for Malaysians.

Wawasan 2020 or Vision 2020, according to the man who crafted it, is by and large dead.

He blamed his two successors for implementing “bad policies”, which caused the vision’s failure.

Undeterred, Mahathir launched Wawasan Kemakmuran Bersama 2030 or Shared Prosperity Vision 2030 on 5 October 2019.

If at first you don’t succeed, try, try again.

There are many permutations to the current politics being played out in Putrajaya, and how the game will eventually end nobody knows. Not even Mahathir.

Holding up corrupt politicians in his previous party to ridicule is one thing but absolving himself of any responsibility for the current parliamentary disarray is quite another.

With the political uncertainty casting dark clouds over Malaysia’s already weakened economy, the spectre of a sovereign credit rating downgrade (currently A- by S&P and A3 by Moody’s) would be another blow to the financial system.

The local stock market was first to suffer.

On 24 February – the day Mahathir quit – the Kuala Lumpur Composite Index (KLCI) slumped 2.7%, stunned by a combination of political upheaval and the spread of COVID-19 globally, concluding a 12-year bull run where the bourse went longer than any others without a 20% correction.

There are signs the bourse may see more downside in the coming weeks and months following the installation of a new head of another coalition government that does not have the mandate of the electorate.

Malaysia’s new premier is 72-year-old Muhyiddin Yassin, a political and pancreatic cancer survivor (he underwent chemotherapy in 2018). He previously held the post of chief minister of the state of Johor and was the deputy of ex-prime minister Najib Razak.

Aviation sector faces uncertainty

Unlike Mahathir, who has a penchant for cars, aircraft and other things that fly, Muhyiddin does not share the same passion.

His choice of who to lead the transport ministry portfolio and by extension, the aviation sector, will be critical in the current COVID-19 environment.

The combination of US-China trade dispute, geopolitical instability and the rapid spread of the plague is just one of the many challenges the new Malaysian cabinet will have to face.

And against this backdrop domestic carriers in Malaysia – especially those that are financially fragile – are in grave danger of collapsing.

Malindo Air, backed by Indonesia’s Lion Group, is reportedly facing a cash crunch.

Asia’s largest discount carrier AirAsia, meanwhile, reported a loss of MYR304 million for 2019 compared to a profit of MYR2 billion the year before. The airline is embroiled in a corruption case with European planemaker Airbus and with the ongoing coronavirus disease, will likely see its stock further depressed.

Like other airlines in the region and beyond, flag carrier Malaysia Airlines Berhad (MAB) is seeing not just a severe decline in flight bookings but massive cancellations and refund requests, according to a memo circulated to all staff.

Indeed, the prognosis for the industry is becoming increasingly acute.

In Europe, Lufthansa said it was scrapping a quarter of its flights due to the virus, a move that will hit the airline’s bottomline in 2020.

Over in the Middle East, Israel’s El Al signaled it was on the brink of collapse after the country’s health ministry imposed travel restrictions.

Singapore Airlines, often seen as a barometer for the health of the industry, announced its management was taking pay cuts on top of slashing its capacity, cancelling flights and looking at asking its employees to go on unpaid leave.

All these, however, pale in comparison when compared to airlines in mainland China and Hong Kong.

The government of Hainan province has effectively bailed out the HNA Group, owner of Hainan Airlines, while Cathay Pacific, pummeled by social unrest for much of 2019 and now hit by COVID-19, is considering retrenchments and deferring plane deliveries.

Economic stimulus can’t protect jobs

Malaysia’s MYR20 billion economic stimulus package revealed on 27 February was long on vision but short on details; it will not be enough to save jobs in the local aviation and hospitality sectors.

For example, one of the measures require Malaysia Airports Holdings Berhad (MAHB), the operator of most of the nation’s airports, to provide rebates on rental for premises at airports as well as landing and parking charges.

But there was no mention of the quantum of the reduction.

Notwithstanding the past week’s omni-shambolic political paralysis, which reinforced many Malaysians’ view that their lawmakers are not only a disgrace but a national embarrassment, the country’s aviation policies remain in limbo.

Malaysia is in poor shape to ease the pain domestic airlines are feeling because it has failed to reform its aviation system.

In November last year the US Federal Aviation Administration (FAA) downgraded Malaysia’s air safety rating to Category 2 (from Category 1), a move with far-reaching consequences. It has been reported the local industry stands to lose MYR4.4 billion from this.

The transport ministry reacted to the downgrade by proposing to merge the Civil Aviation Authority of Malaysia (CAAM) with the Malaysian Aviation Commission (MAVCOM), a move that is seen as rational but one that has not been well thought of, in terms of execution and timing.

The general assumption is that the crisis facing the national airline and aviation sector has been caused more by external factors than plain (pun intended) ineptitude.

Under Mahathir, who has an obsession for many things Japanese, there were many attempts to persuade Japan Airlines (JAL) and other foreign carriers to take an equity stake in moribund MAB.

Why on earth would the Japanese, French (Air France) or Qataris (Qatar Airways) help save MAB by throwing good money after bad?

But more to the point: Malaysian bureaucrats do not understand that in the cut-throat airline business, nobody owes you a living.

Malaysia is a relatively small nation of just over 30 million inhabitants, but an ambitious one.

Its political elite thinks (most times beyond their intellectual capability), it can punch above its weight on the global arena.

In another world all of this would be funny. But this is serious. Malaysia’s economic future and national security are at stake. Its policy makers, a mixed bunch of invertebrate jellies and flip-floppers – now glued together by race and religion – will likely stumble.

It is still too early to calculate the cost of COVID-19 on the global aviation industry but estimates on losses will rise with each passing month. Owing to the political chaos of the past week, Malaysian aviation will be adversely affected.

In fact, Mahathir might be right: the country could “go to the dogs.”

If it hasn’t already.

*Sleep with the fishes: In Book 21 of Homer’s Illiad, Achilles slays Lykaon, then taunts him as he dies, saying “make your bed with the fishes now…”

AirAsia rising

what’s with the shirt, dude? martin soong seems to be asking tony fernandes during a live interview. tv grabshot from CNBC, 1 aug 2019.

Malaysian Prime Minister Mahathir Mohamad and airline CEO Tony Fernandes may not share the same taste when it comes to fashion, but they are of one mind when it comes to aviation.

Or at least when it comes to what the Passenger Service Charge (PSC) ought to be at klia2, the low-cost terminal next to Kuala Lumpur International Airport (KLIA).

Fernandes, the Group CEO of low-cost giant AirAsia, has been waging an on-going battle with Malaysia Airports Holdings Berhad (MAHB) and with the Malaysian Aviation Commission, also known as MAVCOM.

Long story short, from July 2018 MAHB imposed a MYR73 (USD17.30) PSC – from MYR50 – on passengers using klia2 to destinations beyond ASEAN, the 10-member Association of Southeast Asian Nations grouping.

This rate is the same for passengers departing KLIA and other airports in Malaysia.

AirAsia and its low-cost, long-haul subsidiary AirAsia X have always objected to this, arguing that klia2 is less superior to KLIA in terms of facilities and therefore passengers should not pay the extra MYR23.

AirAsia and AirAsia X continued to charge their passengers MYR50 despite the new rate but relented in early August this year after the High Court ordered both carriers on 18 July to pay MYR40.6 million to Malaysia Airports (Sepang) Sdn Bhd (MASSB), a unit of MAHB.

However, in a joint press conference between AirAsia and Airbus to announce an aircraft order for the airline on 30 August – a day before Malaysia’s Independence Day – the government reduced the PSC for international flights to MYR50 (from MYR73) at all airports save for KLIA effective 1 October.

malaysian premier mahathir mohamad (receiving a model plane from airbus CEO guillaume faury) was guest of honour at an airbus-airasia order announcement on 30 august. pic/airbus twitter account

Fernandes acknowledged it was indeed a Merdeka (Independence) Day gift for his company and to show his gratitude, announced special fares in October that will be called “Anthony Loke Special”, in honour of the Malaysian transport minister who announced the reduction.

MAHB shares slumped 6% on the news. But MAHB isn’t the only entity in AirAsia’s crosshair.

In May this year AirAsia and AirAsia X took legal action against MAVCOM over the latter’s refusal to mediate over the dispute between the airlines and MASSB.

This latest victory for AirAsia marks a terrific transformation for the airline and especially for Fernandes.

From being publicly vilified for cosying up to ex-premier Najib Razak days before the General Elections in May 2018, he is now – just slightly over a year later – celebrated and championed by Mahathir, Najib’s nemesis.

who’s having the last laugh? tony fernandes with ex-PM najib razak. pic/najib razak facebook

The truth, however much we tell ourselves otherwise, is that lobbying in aviation (as in politics) has always been inescapable.

As Fernandes himself explained (and grovelled) in this video clip airlines had to accommodate the realities of politics, be it in Malaysia or elsewhere.

To help his cause Fernandes has a powerful weapon in the form of Rafidah Aziz, a former international trade minister popularly known as Malaysia’s “Iron Lady” and currently AirAsia X’s chairman.

She served under Mahathir during his tenure as fourth prime minister and apart from being highly regarded, also has the nonagenarian’s ears.

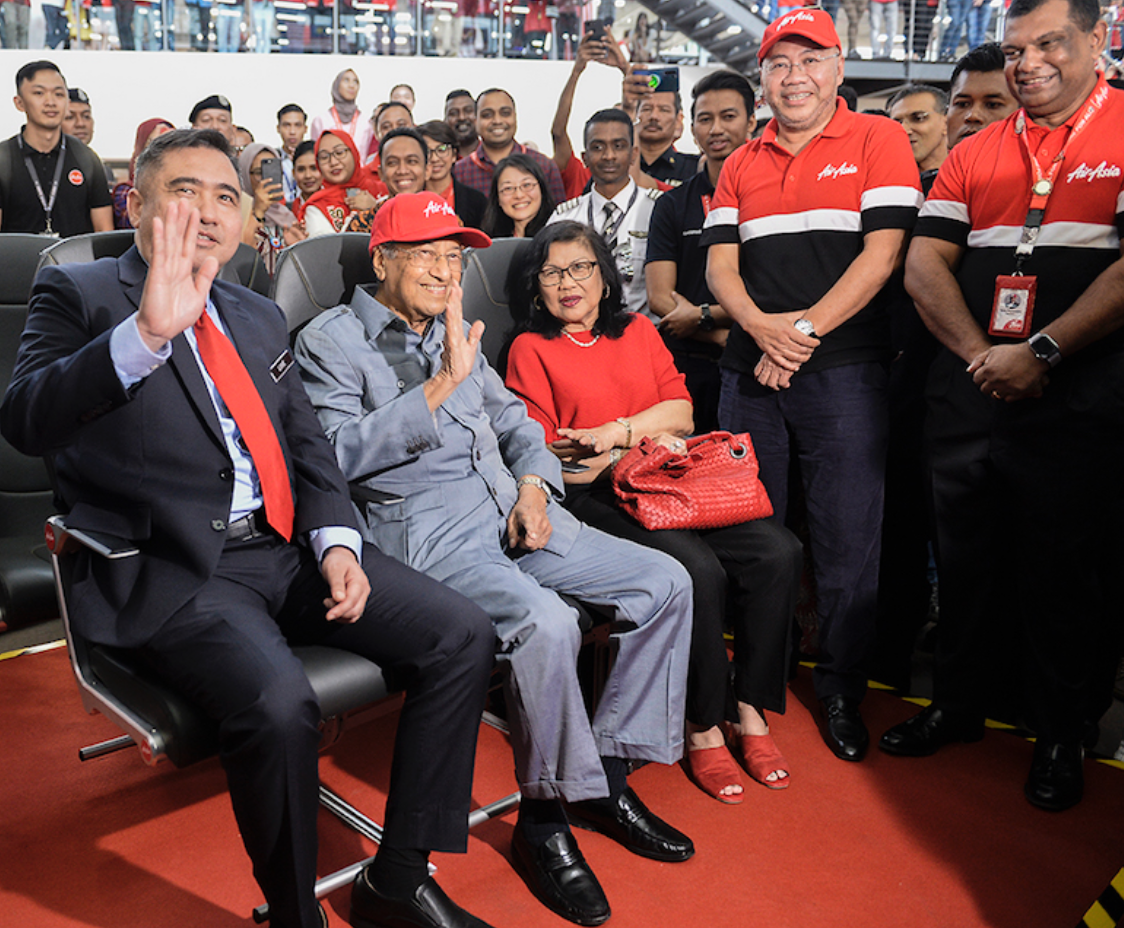

airasia x chairman and “iron lady” rafidah aziz (on mahathir’s left). transport minister anthony loke is at far left. standing next to fernandes is airasia co-founder kamarudin meranun. screenshot from the malaymail

In another video clip from 2002 where Mahathir announced he would resign during a party gathering, Rafidah was among the first to rush to console the teary premier.

Rafidah and Fernandes make a great tag team. Both MAHB and MAVCOM stand no chance against such a formidable force.

The government’s pronouncement over the change in the PSC rates came just before AirAsia X and Airbus held a press conference to announce the carrier’s order for 42 aircraft worth USD5 billion.

For all the skepticism of the government’s U-turn in the PSC charges, and despite a stubborn semblance of prejudiced views by some critics of the airline, there is no denying AirAsia is a Malaysian success story.

Accusations of flip-flopping is nothing new for Malaysia, for this government or its predecessor.

The ability to change minds (and policies) quickly – irrespective of what the rest of the world thinks – is a uniquely Malaysian phenomena.